Looking Back and Grading the 10 Themes for 2022

Key Takeaways

- Resilient consumers help U.S. economy avoid real recession

- P/E contraction has kept the S&P 500 from new highs

- Most daily 1% swings for S&P 500 since 2009

As your Investment Strategy Team, the ability to look ahead and anticipate material developments that could alter our economic and financial market outlook is critical. Reflecting on the past affords us the opportunity to critique our views and analysis. Therefore, as we prepare to release our Ten Themes for 2023 we’ll grade our themes for the current year. There is no way to sugarcoat our performance – we have been humbled and expect that it will be an aberration. As we averaged 87% the previous three years, this year was subpar at 65%. The main reason? The Russia-Ukraine war dramatically worsened inflation and shifted our outlook for the Fed – and in turn, negatively impacted most asset classes. Below is our 2022 scorecard.

- The U.S. Is Ready To Take Off (Scorecard: Even) | Following the best year of growth since 1984, the economy was expected to slow in 2022. GDP was negative for two consecutive quarters, the technical definition of a recession, as inventories, trade, inflation, and the Fed’s tightening cycle weighed on growth. However, a real recession was avoided because of a resilient consumer and strong labor market (+4.3 million jobs added YTD).

- The Fed Must Adeptly Navigate The Fast-Moving Economy (Scorecard: No) | Instead of being patient and pragmatic, the Fed was compelled to act as the Russia-Ukraine war, higher consumer prices and significant stimulus payments caused inflation not only to soar, but persist. Stubbornly high inflation led the Fed to raise rates by the largest amount in a year since the early 1980s, bringing the Fed’s target rate to the highest level since 2007.

- Yields Will Swerve Between The Gates (Scorecard: Yes) | As expected, Fed tightening caused yields to rise and led to negative returns for bonds. The 10-year Treasury yield rose nearly 200 basis points – the largest annual increase since 1994 – to reach the highest level since 2008. As a result, the Barclays Aggregate Bond Index is headed for its worst year since at least 1975.

- The Democratic Blue Wave Is Skating On Thin Ice (Scorecard: Yes) | Believing that the polls would narrow, gridlock was our anticipated outlook following the midterm elections. While Democrats maintained the Senate, Republicans were able to flip the House. While this escalates budget debates and the risk of a government shutdown, it also reduces the risk of a major policy shift (e.g., tax hikes).

- Equities’ Transition From Power & Speed To Targeted Precision (Scorecard: No) | Earnings growth and healthy margins were thought to lead the S&P 500 higher this year. While both catalysts came to fruition, it was not enough to counteract the geopolitical risk and aggressive action by the Fed and other central banks that brought the bull market to an end. P/E contraction for the second consecutive year is leading to the S&P 500’s fourth worst annual performance since 1945.

- Sector Exposure Will Steer Small Cap In The Right Direction (Scorecard: Yes) | Attractive valuations led us to favor small-cap equities entering the year. But better earnings growth and sector exposure also helped small cap outperform large cap by 130 basis points. For example, the S&P 600 has higher weightings to Financials and Energy and less exposure to Tech and Communication Services.

- There Are No Bindings On Technological Re-Invention & Adoption (Scorecard: No) | We believed elevated valuations wouldn’t stop the Tech sector’s momentum, but the aggressive Fed tightening cycle did. Despite resilient corporate technology fixed investment, the sector is set to underperform the S&P 500 on an annual basis for the first time since 2013 and by the widest margin since 2002.

- Focusing On U.S. Equities’ Consistent Stride (Scorecard: Yes) | We favored domestic equities due to the relatively stronger economy, positive earnings growth, and more favorable profitability ratios. Due to the impacts of the Russia-Ukraine war and COVID lockdowns in China, US equities are set to outperform international equities for the fifth consecutive year.

- Oil Price Dynamics Will Find Their Balance (Scorecard: Yes) | We anticipated oil prices moving higher in 2022 as the economy reopened, but that any upside move would be limited as supply and demand normalized exiting the pandemic. Oil prices have risen slightly since the start of the year, but it was the war-induced price surge that benefitted our call to be overweight the Energy sector as it has been the top performing sector and has outperformed the S&P 500 by over 75% year-to-date.

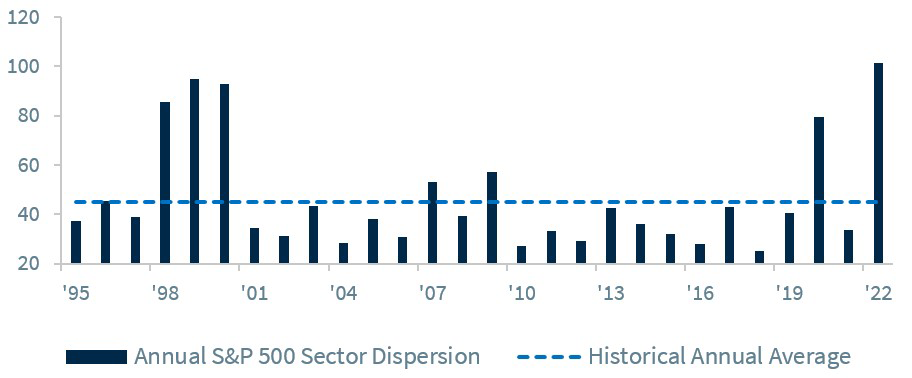

- Look Below The Surface For Opportunities (Scorecard: Yes) | After a calm 2021, volatility was set to increase. And it did drastically. Two decades of muted geopolitical risk reversed, and market expectations for Fed action led to the S&P 500 experiencing the most 1% daily moves since 2009. As such, active money managers are expected to outpace their benchmarks for the first time since 2013.

Original article from Raymond James CIO Larry Adam, additional information from Financial Insight’s Portfolio Manager Mike Ruff.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.