Tax Planning & Washington Estate Tax

As part of our comprehensive financial planning services, we offer tax planning and tax mitigation strategies designed to align with your goals, ensuring that you stay compliant while taking advantage of all available tax benefits.

For Washington state residents or individuals who own property in Washington state, we also help with planning for the Washington Estate Tax.

Tax Planning

To help our clients make more informed decisions about their financial goals, they can take advantage of:

- Tax modeling and projection for income changes

- Tax modeling and projection tax law changes

- Tax modeling and projection for the sale of a business

- Tax projections for large capital gains on investments and/or sale of a business or property

Clients with $2 million or more in assets with us also receive tax preparation services, including trust and 1040 tax filings, at no additional cost.

Tax Mitigation Strategies

Some of the tax mitigation strategies we employ to help clients reduce taxes may include:

- Utilizing tax-advantaged retirement accounts like IRAs, Roth IRAs or SEP IRAs, SIMPLE IRAs, and 401(k)s for business owners

- Roth IRA Conversions

- Tax Loss Harvesting Plans

- Qualified Charitable Distributions

- Withdrawal Sequencing

- Asset Location (Strategic placement of investments in taxable/tax-deferred/tax-free accounts)

Our process always begins with the client, understanding your short and long-term goals, risk tolerance, and current situation before making any recommendations that could affect your tax situation or financial plan.

If we see an opportunity to utilize any of the tax planning or tax mitigation strategies as we review your situation, we will let you know and will be happy to answer your questions as needed.

Washington Estate Tax guidance

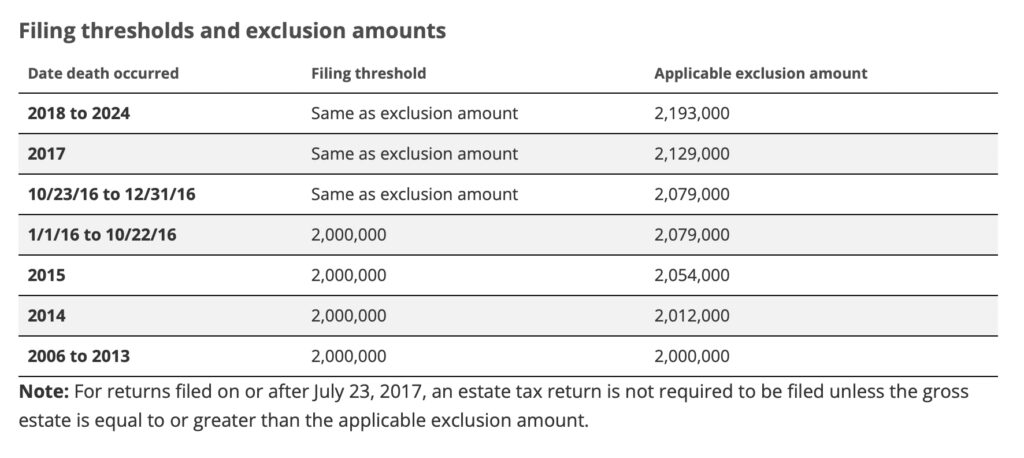

Did you know that if you live in Washington state and pass away with an estate greater than $2,193,000 (as of 2024), your estate may be subject to the Washington state estate tax?

We help clients find ways to minimize Washington estate tax using our deep expertise in tax and estate planning.

How does Washington estate tax work?

The Washington estate tax is a tax levied on the estate of an individual who passes away and was either a resident of Washington state or owned property in Washington state.

Whether or not you owe estate taxes in Washington will depend on the value of your taxable estate.

Your taxable estate in Washington is the value of your gross estate (may include property such as stocks, bonds, cash, real estate, life insurance, annuities, retirement accounts, and tangible assets such as vehicles, jewelry, etc.) minus any deductions allowable in Washington state. These deductions might include:

- Marital deduction

- Charitable deductions

- Family-owned business interest deduction

- Farm deduction

- Debts and administration expenses

If the total value of your estate exceeds the filing threshold as set forth by the Washington state government, you are required to file a Washington estate tax return, even if you don’t owe any tax.

In 2024, if your estate is greater than $2,193,000, you may owe estate taxes on any amounts over this value at the tax rates below as per the Washington State Department of Revenue:

Source: https://dor.wa.gov/taxes-rates/other-taxes/estate-tax-tables

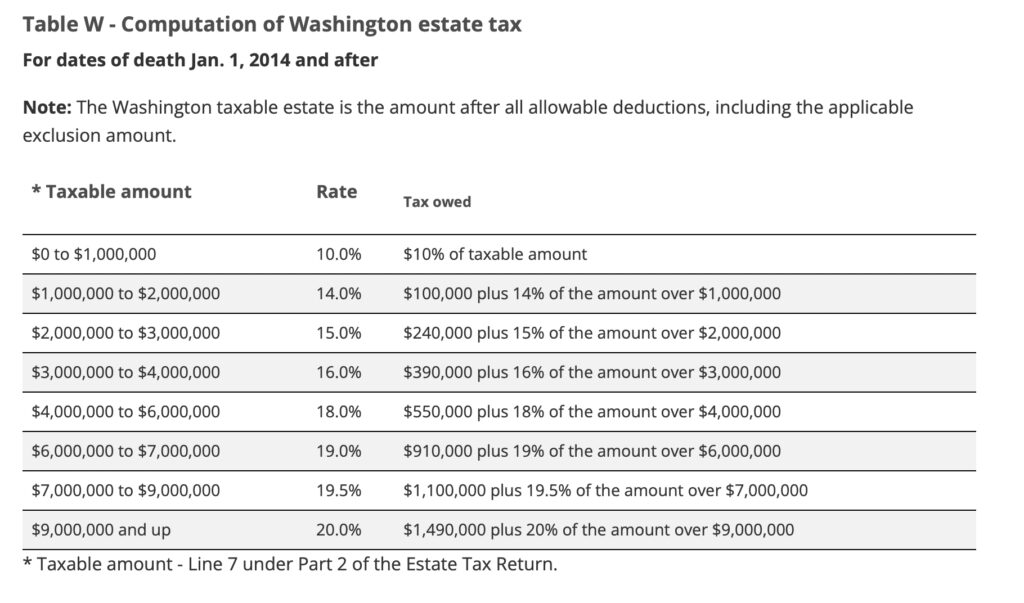

What are Washington estate tax rates?

The Washington estate tax ranges between 10% to 20% and is progressive, meaning the rate of taxation increases with the value of the estate. The latest Washington estate tax table can be found below:

(Source: Washington State Department of Revenue)

The good news is, there are ways to reduce this tax such as through certain types of trusts, charitable donations, and gifting. While Washington state does not have a gift tax, be mindful that you may need to file a federal gift tax return if you give more than $18,000 to an individual (in 2024) in a given year. Any gifts above this amount start counting towards your lifetime exemption amount and you don’t owe tax until you exceed this amount (currently $13.61 million per individual).

What about the Federal Estate tax?

Depending on the value of your estate, in addition to the Washington estate tax, you may also need to plan for the federal estate tax. While the Washington estate tax exemption is currently $2.193 million per individual, the federal estate tax exemption is much higher at $13.61 million per individual (in 2024). This means that if your estate is under $13.61 million, you do not owe federal estate taxes. If your estate is over that amount, you may owe estate taxes at federal tax rates for trusts.

There are estate planning strategies, however, that you can use to reduce your federal estate tax, and – if you’re a married couple – may be able to protect up to $27.22 million from federal estate taxes. The federal tax exemption amount is set to decrease significantly in 2025 and beyond, however, making it crucial to start setting a plan in place now.

If you’d like to schedule an introductory meeting with our team to discuss your tax and estate situation, you can do so here.