Market Update

Review the latest Weekly Headings by CIO at Raymond James, Larry Adam.

Key Takeaways

- Anticipating improvements in the August inflation reports

- Retailers are discounting as they offload inventories

- The streak of declining gas prices continues

The lights are on, and the stadiums are packed which means football is finally back! While the college season has already started, the defending champions from Los Angeles kicked off the start of the professional league with a loss to Buffalo. Whether it be the crowd noise, tailgating, camaraderie, or impressive displays of athleticism, football has something for everyone. In addition to football, this fall will be eventful for the team of monetary policymakers at the Federal Reserve (Fed). Quarterbacked by Chairman Powell, the Fed will draft the route for tightening policy as it is steadfast on moving the chains on inflationary pressures. While there are still some yards to cover before the peak terminal interest rate is reached, the Fed is full of veterans who are continuously assessing the economic field.

- Bottom Line – Lining Up A Play Against Inflation | The markets are awaiting the August inflation reports (CPI released Tuesday September 13 & PPI released Wednesday September 14), and our scouting report is projecting signs of improvement. Why? There is a full line-up of indicators reflecting easing inflationary pressures—even a few from the stickier areas of inflation.

- Fact Not Fantasy, Money Supply Is Normalizing | The year-over-year pace of money supply growth peaked at nearly 27% in February of last year as unprecedented levels of fiscal stimulus throughout the pandemic significantly increased the amount of money in circulation. Since then, the pace has rapidly slowed and is now just over 5% and trending lower.

- Stronger Dollar Moved The Goal Posts For Imports | The dollar is at the strongest level versus the euro, pound, and yen since 2002, 1985, and 1990, respectively, which has drastically cheapened the cost of imported goods.

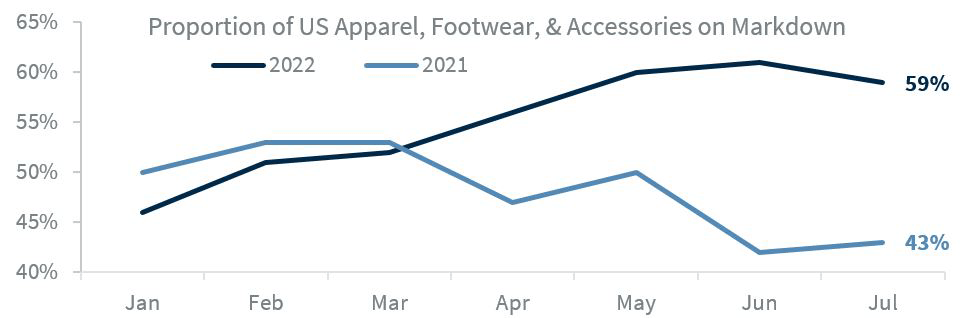

- Promotional Activity Now In The Field Of Play | During the pandemic, goods were hard to find, let alone find on sale. But now, retailers are discounting as they offload bloated inventories that are 20-40% above pre-pandemic levels. For example, the proportion of apparel, footwear, and accessories that was on markdown in July was ~60% versus 43% a year ago.

- Shipping Costs Have Snapped Backed | In September 2021, trans-pacific shipping costs (route from Shanghai to Los Angeles) peaked at over $12k per container. Following the biggest weekly drop in ocean freight rates this week (-14%), the cost today is ~$4.8k. A slowing of freight costs, a big expense in determining how much goods are sold for, is a positive sign.

- Supply Chains Off The Sidelines | COVID-induced global lockdowns and the Ukraine/Russia conflict prolonged global supply chain disruptions. However, the New York Fed’s Global Supply Chain Pressure Index declined for the fourth consecutive month in August to reach its lowest level since January 2021 as both delivery times and backlogs improved.

- Lower Gas Prices Are A Game Changer | The national average price at the pump has fallen for 86 consecutive days and more than $1.25 from the peak. This is the longest streak of declines and third largest price drop since 2015!

- Semiconductor Prices Stop Piling On The Pressure | Semiconductor prices have fallen over 10% from the January peak and are likely to improve in the years ahead as governments and companies across the globe invest heavily in chip manufacturing. In fact, Apple’s proprietary chips are one reason why it was able to hold product prices steady in the US.

- Car Prices Break From The Inflationary Huddle | The Manheim Used Vehicle Value Index has declined for three consecutive months (and six out of the last seven months) and is at the lowest level since September of last year.

- Commodity Prices Not Causing Unnecessary Roughness | As the pace of global growth slows, the prices for many economically-sensitive commodities have declined—such as copper down 26% from its peak.

- Consumers Will Stop Fumbling With Higher Food Prices | While the food component of CPI remains elevated, there are some early signs of easing prices. The UN Food Price Index has declined for five consecutive months to the lowest level since January, with wheat and corn down 35% and 15% from their recent peaks, respectively.

- Rents No Longer A Glaring Interference | Rent prices have historically lagged the direction of housing prices (which have started to see a deceleration in price gains), but real-time data suggests that rent growth is already easing. In fact, Zillow Observed Rent (based on a national averages) has decelerated from over 17% to 13% (year-over-year) since February.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.

The views expressed represent the opinions of Financial Insights, Inc. (Financial Insights) and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person.

Additional information, including management fees and expenses, is provided on Financial Insights’ Form ADV Part 2, which is available upon request.